Doing More With Data: a Supply Chain Perspective

Rick Bingle, SVP of Supply Chain for REI

Founded in 1938 by a group of Pacific Northwest mountaineers seeking quality equipment, REI operates retail stores nationwide, two online stores and an adventure travel company called REI Adventures. REI offers products from top brands for camping, climbing, cycling, fitness, hiking, paddling, snow sports and travel, including its own line of outdoor gear and apparel. Senior Vice President of Supply Chain Rick Bingle is responsible for managing and growing the distribution and logistics function in order to provide quality experiences for all REI members. He shares ways in which the company leverages data to ensure they are working effectively to complete business functions and satisfy consumer needs.

“Supply chains are defined differently across different organizations,” he says. “At REI, I am accountable for our omni-channel fulfillment strategy, which includes in-store fulfillment, buy online/pick up in store fulfillment and vendor inventory fulfillment. I am also responsible for overall international logistics—moving our private brand's products to each of our supply chain distribution nodes and then to our end-user customers and stores. My responsibilities also include overseeing our call center and how we interact with our customers.”

He says his goal is to ensure that customers can have free-form access to the organization through their preferred method.

“The only way to meet our customers’ needs is to have a deep understanding of how they interact with operations,” he says. “We analyze where they like to purchase, the timing and what information they seek out as they go through the buy-and-receive cycle. The more information we have, the better prepared we are to fulfill their needs and preferences in each interaction.”

He says these data insights enable the supply chain team to make strategic operational decisions across the company about how and where to position inventory.

“All of the data about our customers—including how loyal they are, where they like to shop, how often they shop and whether they buy full-price items or look for promos—allows us to pull together a deployment strategy that fits our customers’ needs,” he says.

REI is a membership-driven organization, which provides a significant advantage in terms of gaining data insights.

“When a customer creates a member profile, we are able to see all of the data around that individual shopper and their history with us,” he says. “We can then pull that data and analyze it through different lenses. The marketing group can look at it in ways to create frequency, action and retention. In the supply chain, I seek out customer data that focuses on transaction fulfillment and timeliness.”

He says that transactional data connecting back to an individual member is instrumental in elevating the supply chain process.

“Every company has transactional data, but I am able to connect that data back to an individual member,” he says. “I can get down to the level of granularity that allows me to analyze, for example, how cyclists tend to buy at a certain time of year in a given location and whether or not I am meeting the needs of those cyclists in terms of inventory fulfillment.”

He says the challenge for his team is not the sources of data, but rather the inferences they are able to achieve from the data.

“Our challenge isn't so much the absence of data but how quickly can we review the data and create inferences from it,” he says.

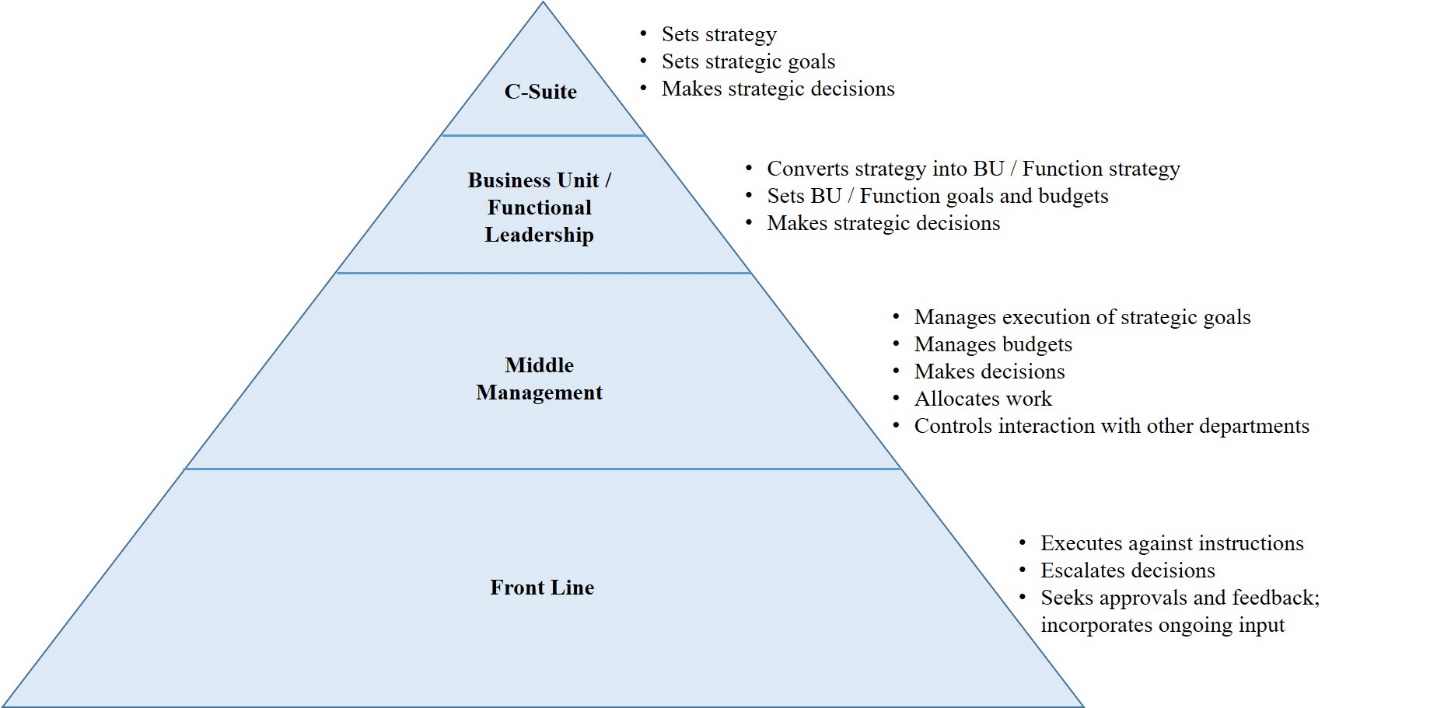

In retail, it is vital for supply chain and operations to listen to both marketing and merchandising. However, each team still uses its own unique tools, making collaboration more difficult.

“The idea of bringing all of the key voices together to create a unified conversation is a real challenge in any retail environment today,” he says. “Each department has its data streams, but we need to unify those streams to drive a conversation that keeps the entire organization working together toward a unified goal.”

In an ideal world, he says he could sit down with the divisional leads of marketing, merchandising, product, retail and operations and easily connect all of the disparate information from them to create a holistic understanding of how everything comes together. In the absence of a system that unifies them, he says they have collaborative, cross-divisional conversations that allow them to constantly tweak their alignment.

These conversations are held in the form of bi-weekly, cross-functional meetings in which the teams analyze sales trends in both a backward- and forward-looking way. The operating plan is set up through the lens of how to drive frequency and customer traffic, establish the product plan, lay out what will be on sale and when, and analyze customer communications through digital versus in-store.

“The merchandisers talk about the product plan, the marketing team talks about their engagement tactics, the retail team talks about strategy, and the operations team needs to ensure that we have the capacity to meet the expectations raised in the conversation,” he says.

REI differentiates itself as a company through the experiences they are able to create online and in stores.

“We are able to differentiate ourselves on the experience side, so part of what we ask is how we should differentiate ourselves in our operations,” he says. “If we believe our real differentiation is in the experience, then we need to ask ourselves about our own customer transactions and understand whether we are meeting market expectations.”

He says this drives a very different conversation relative to the data.

“We have set up call customer transaction models, and we analyze the individual transaction that the customer goes through from their point of view,” he says. “This is a real shift from how the supply chain tends to think about a ‘perfect order,’ which is one where we fulfill an order on time and with no errors. Our customer transaction model allows us not only to see the transaction, but also to marry it to customer expectations so that we can make a fundamental difference to our customers.”

He says there are hundreds of measures around how to look at logistics, but organizations that have superior supply chains focus on just a handful of data points that really change the outcome, whether for customers or financially. At REI, they look at four unique measurements.

“We measure expense percent, cost per unit, units per hour and our critical customer transaction models,” he says. “To move the needle in operations, we need to have robust measures around receiving processing, production, shipment and quality. By looking at the three financial components, as our product mix changes, we can understand how our team is optimizing the bottom line. By adding the customer component, we are able to connect our customer needs to our company needs.”

He says their data analysts have aggregated a number of tools that are helping to make this process far easier.

“We have been on a path for about two years to merge our product data and our customer data into one place,” he says. “This enables us to bring together our operations and customer data, and by having this data in one place, we are better able to create a unified perspective around the data.”

He says the biggest difference around data insights comes in hiring the right people.

“REI has made a conscious effort for the last several years to elevate the importance of analytics,” he says. “We have always been product-oriented; our goal is to get people into the outdoors through our products. However, we realize that it is not just about putting a great product on the shelf. It is also about our ability to meet customer expectations by analyzing what we see in the data.”

He says they started by bringing in analysts, which allowed them to begin identifying data gaps. Then, they sought out tools that could bridge those gaps. The next piece is to integrate artificial intelligence.

“We are not looking to replace our analysts with AI, but rather empower them with it,” he says. “AI enables us to address many more issues each day, and it accelerates the ability for our analysts to extract, communicate and potentially change strategies. Analysts now have tools to visualize data and bring it all together in one queue, thereby facilitating cross-functional collaboration. Now, organizations need to think about creating horsepower behind the scenes that accelerates the analyst.”

This interview was one of 12 interviews of leading executives across marketing, commerce, supply chain and data for a report done in partnership with our sister network, the CMO Council. To purchase the full report, including all interviews in full and 20 charts and graphs from a survey of 165 executives, or to download a free executive summary, visit: https://cmocouncil.org/thought-leadership/reports/doing-more-with-data.

Share

Share